Table of Contents

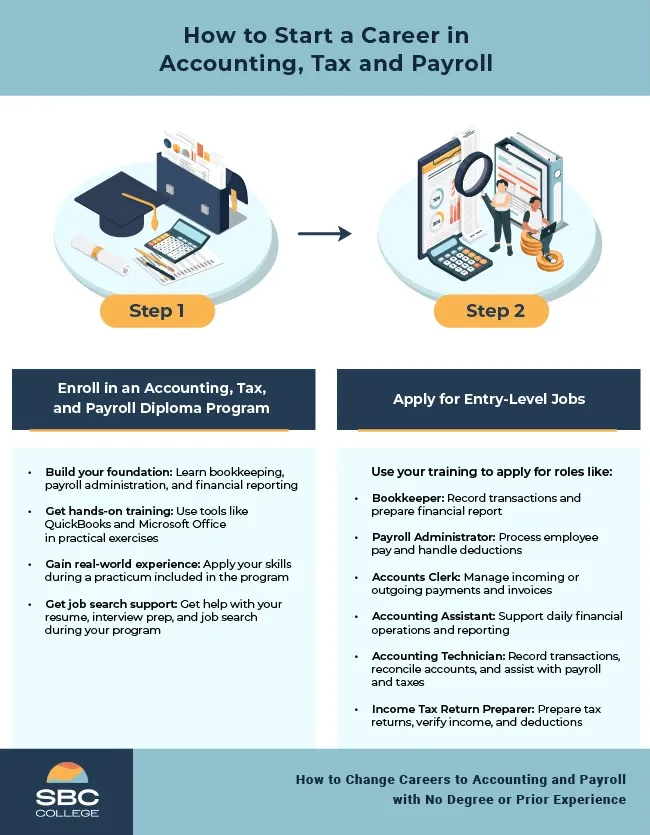

Switching to a career in accounting, tax and payroll is possible even if you’ve never worked in the field before.

Many entry-level positions are open to those who complete an accounting, tax, and payroll diploma in Canada, where you’ll learn the basics of financial accounting, income tax preparation, payroll management, and bookkeeping software. It’s a practical choice for anyone looking for a job that’s easier to train for, consistently in demand, and offers room for growth.

In this article, you’ll explore what makes a career in accounting so appealing, how the SBC College Accounting, Tax, and Payroll Diploma builds essential job skills, and the type of roles you can pursue after graduating.

Listen to: How to Change Careers to Accounting & Payroll with No Degree or Prior Experience

Why Choose an Accounting, Tax and Payroll Career?

The accounting, tax and payroll field is a popular choice for career changers, newcomers to Canada and those starting out because it offers steady job opportunities, competitive pay, and doesn’t require years of training to get started.

The skills you’ll develop apply in almost every sector, so you’re not limited to a specific workplace. From healthcare and education to finance, retail, and non-profits, there’s always a need for people who can manage payroll, organize expenses, and keep financial records in order.

With a third of workers in the field aged 50 or older, many professionals are nearing retirement. This shift is contributing to the positive accounting job outlook, with more jobs opening up for new talent equipped with practical training.

If you want a career with long-term demand and flexibility to work in different industries, accounting is a good place to start.

How SBC’s Accounting, Tax, and Payroll Diploma Prepares You for Success

Starting with the right training can make all the difference when you’re changing careers or starting fresh.

Andrew C., an Accounting, Tax, and Payroll Program instructor at SBC College, shares what that foundation should look like:

“Choosing a comprehensive accounting, tax and payroll program sets the tone for your entire career. It trains you to interpret financial data, solve business problems, and explain the numbers behind day-to-day decisions.”

That’s exactly what the SBC College Accounting, Tax, and Payroll Diploma Program is designed to deliver. You’ll develop skills in bookkeeping, payroll processing, financial reporting, income tax preparation, and accounting software. You’ll also learn how to apply Canadian tax and payroll regulations and prepare and interpret financial data that helps organizations understand their financial position.

For those balancing other responsibilities, the program offers flexible online learning options. As Rita I., a recent graduate shared:

“While I worked and had no time during the business hours, I wanted to gain additional qualifications in Accounting/Bookkeeping. A colleague introduced me to SBC’s online program, and the experience was amazing. The instructor was helpful, quick to respond, and explained everything clearly. It felt like an actual face-to-face class.”

Whether you’re starting fresh or returning to school after time away, the diploma prepares you for accounting, tax and payroll entry-level jobs across a variety of workplaces.

What Skills and Software Will You Learn?

Each course in SBC’s Accounting, Tax, and Payroll Diploma Program develops your ability to work with numbers, organize data, and support daily accounting tasks. Here are the core skills you’ll develop during the program:

- Payroll and bookkeeping skills: Learn how to calculate pay, apply payroll deductions, and record financial transactions accurately using industry standards.

- Payroll rules and compliance: Gain the knowledge to apply employment classifications, calculate statutory deductions, follow remittance procedures, and complete year-end payroll reporting.

- Financial accounting methods: Learn how to complete the full accounting cycle, apply internal controls, work with inventory costing and valuation, and prepare key financial statements.

- QuickBooks training: Gain hands-on practice with setting up and entering income and expense information, managing clients and suppliers, invoicing, and processing payments.

- Microsoft Office tools: Use formulas, charts, and tables to analyze financial data and create organized spreadsheets for day-to-day work.

This mix of skills and tools reflects what you’ll use in your everyday accounting work.

What Entry-Level Roles Can You Get After Graduation?

The skills you build during your diploma training prepare you for a range of entry-level accounting jobs. Here are a few paths you can take:

Bookkeeper

You’ll track every dollar that goes in and out of a company. This includes logging transactions, balancing accounts, and using tools like QuickBooks to create financial reports. Your work helps finance teams monitor income, expenses, and cash flow.

Payroll Administrator

In this position, you’ll manage employee pay. You’ll review timesheets, calculate wages, apply deductions, and prepare forms like T4s and ROEs. Your work keeps the payroll accurate and helps the company stay aligned with employment standards and tax rules.

Accounting Technician

You’ll work directly with financial data, recording transactions, managing receivables and payables, performing reconciliations, and assisting with payroll and tax remittances. This role builds on your technical accounting skills and supports accountants by preparing financial information they use for analysis and reporting.

Income Tax Return Preparer

In this role, you’ll prepare tax returns by collecting financial records, checking income and deductions, and completing tax forms. You may also meet with clients to review their information and answer basic questions about tax rules. Your work will help clients file accurate returns and meet tax deadlines.

Each of these roles offers a different way to apply your training, depending on what interests you most—whether it’s working with numbers, handling payroll, or supporting a finance team in an organization.

Starting a career in accounting can be as easy as enrolling in a career-focused diploma program.

At SBC College, the Accounting, Tax and Payroll Diploma Program focuses on the practical skills and tools you’ll use every day, including financial accounting, payroll management, income tax preparation, and online bookkeeping. With flexible learning options, hands-on practice, and dedicated career support, you can prepare to enter the workforce as soon as you graduate.

To get started, contact an admissions advisor today.

Frequently Asked Questions (FAQ)

Is prior experience required for SBC’s Accounting, Tax & Payroll Diploma?

No experience is required to enrol. The program is designed for those new to the field, including career changers, newcomers to Canada, and those starting fresh. It starts with foundational concepts and gradually builds your skills through practical, hands-on training.

How long does the SBC Accounting, Tax, and Payroll Program take?

The diploma can be completed in less than a year. This includes classroom instruction and a practicum to apply your skills in a professional setting.

Can I work while studying, and are online options available?

SBC offers flexible study options, including online learning.

What support does SBC offer for job placement?

All SBC diploma students receive support from Career Services with resumes, interviews, and job searches. After completing all coursework, students begin a practicum placement that provides hands-on experience and opportunities to connect with employers.

Can mature students or career changers succeed in this program?

Yes. Many students at SBC are returning to school after time away or switching careers entirely. The program is designed to support learners at all stages, with instructors with years of industry experience to guide you and help you build the essential skills to succeed in the field.